Themes Explained

My expostulations here at Seriously, Marvin! are rooted in a deeper framework. Beneath the clamor lies a structured thematic framework I developed over years. The Themes that underly it shape how I understand markets, policy, and geopolitics, and they form the foundation of my broader research.

To see how these Themes play out in markets and portfolios, explore them in full at Thematic Markets. If you want the big-picture framework behind the commentary, here is the cheat sheet.

My Thematic Approach

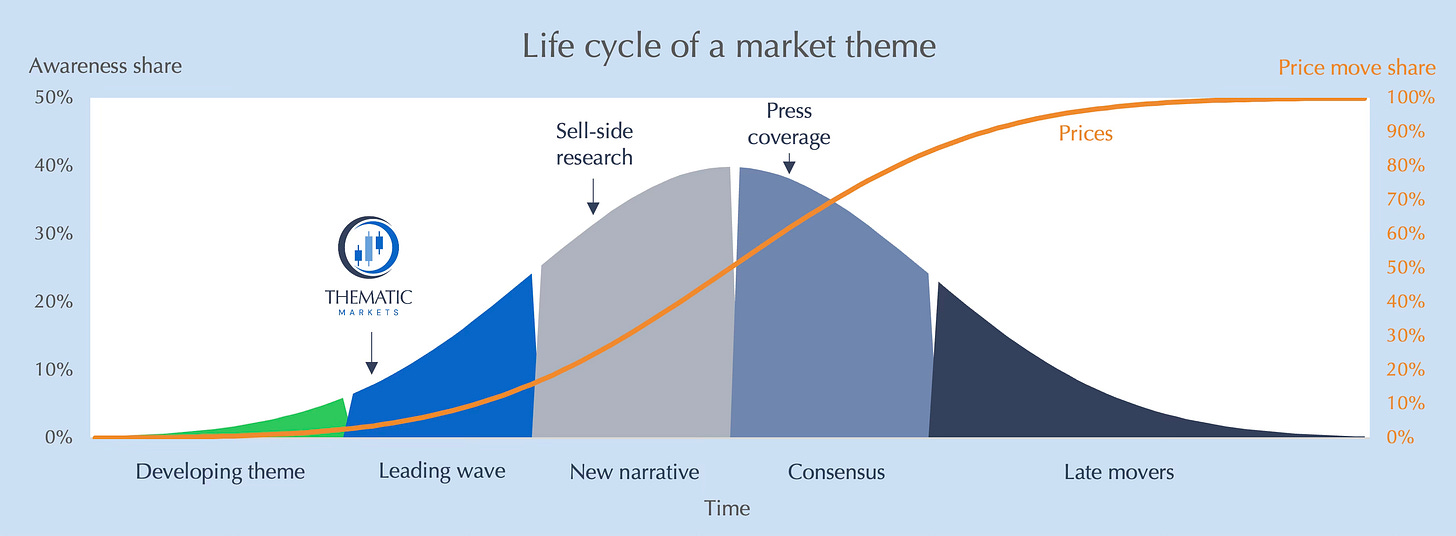

The Thematic approach to analysis recognizes that most trends in the global political economy and markets are driven by long-lived natural, evolved phenomena – or Themes – whose effects, like the speed or position of subatomic particles, may change when observed. Themes have a life cycle, arising in the background unnoticed, like Adam Smith’s “invisible hand”, before their effects are observed by early identifiers and later enter the consensus’ consciousness with a “name” (e.g. hyperglobalization, or Bretton Woods II).

Early identification and understanding of emergent themes enables one to better make sense of the global political economy, improving market forecasts and putting you ahead of the consensus (see Successes).

Themes are different from narratives, though they may overlap at times. Understanding the difference is crucial. Narratives are powerful ad hoc storiescreated to sell products (e.g. BRICS) or to explain phenomena that markets struggle to understand (e.g. secular stagnation or new normal). Themes are the fundamental phenomena that cause the things markets can’t explain. When narratives align with Themes, they powerfully amplify Themes’ effects on market prices. But when they are at odds, narratives can lead to fundamental divergence that ultimately resolves in dislocating volatility (e.g. in 2022 when bond markets’ secular stagnation narrative met the fundamental reality of Localization).

The following Themes have driven the global political economy for the last three decades. Current Themes are those driving the political economy and markets today. But past Themes often have lingering effects and are crucial to understanding both how we got here and the causal origin of current Themes.

Current Themes:

🔹 Localization

Long before protectionism, Covid and security concerns accelerated the process, technology began unwinding globalization. Automation allows production to move closer to consumer, obviating extended supply chains. Localization of production is reshaping trade, capex and relative growth. It has driven higher real interest rates, supercharged US earnings, and a decade of emerging market underperformance.

🔹 Being is believing

Expectations create reality. Inflation, growth, and even political legitimacy hinge on belief systems that can flip suddenly, destabilizing regimes and markets. It wasn’t Covid’s supply and demand shocks that created higher inflation — those just helped — it was a shift in beliefs, which is why inflation remains stubbornly persistent.

🔹 Global entropy

The post-War liberal order (PWLO), like any order, is subject to entropy, or dissolution. The PWLO’s entropy began in the 1990s but has reached a tipping point. The US no longer wants to nor can play world cop and strategic challengers are actively building foundations of a different order. Both global and country risk premia, as well as trade and economic growth are at stake.

🔹 Complexity cascades

Failures of complex systems don’t propagate linearly. Their effects are unpredictable and risk destabilizing other complex systems, creating a nonlinear cascade of disorder. Global entropy, the Politics of Rage, and Localization all risk Complexity cascades, increasing the intrinsic potential for tail risks.

🔹 Uncertainty

Uncertainty — nonquantifiable risk, “unknown unknowns” — is always with us but Global entropy, the Politics of Rage, Localization, and the risk of Complexity cascades have increased its potential. In a world of “overquantification” and false certainty, risk premia and options likely are underpriced.

🔹 Politics of Rage

Though only noticed by most a decade ago, the populist voter rebellion behind the Politics of Rage has been brewing for four decades as elites have disconnected from the masses and ceased representing their interests. Both the rebellion and the elite backlash against it are destabilizing Western politics with implications for growth, debt and risk premia.

🔹 Missingflation

Decades of systematically one-sided inflation forecast errors show how Being is believing outperforms backward-looking Phillips Curve models and the underlying flaws of modern, inflation-targeting central banking. Term premia and long-dated breakevens do not properly account for Missingflation.

🔹 Global bifurcation

Global entropy is most likely to evolve into the already nascent new world order of Global bifurcation: Two competing blocs, Western and Eastern, with rival political economies, trade and payments networks, and technology standards that force hard choices on everyone else. Choose wisely, as it will affect your growth prospects and risk premia.

🔹 Cultural dissonance

The West’s inability to comprehend that its values are not “universal” and are even antithetical to many other cultures is a form of Cultural dissonance that strategic rivals are weaponizing to advance Global entropy and overturn the post-War liberal order. Western legitimacy — and risk premia — are at stake.

🔹 Illusory omnipotence

Western elites often act as if their institutions and policies can control complex global systems. This hubris erodes credibility and accelerates fragility when reality resists their control. It may dampen near-term volatility but it risks greater upheaval in the long run.

Past themes with lingering consequences:

🔹 Apex neoliberalism

The post–Cold War triumph of liberal capitalist democracy delivered prosperity and peace, but also bred arrogance that sowed the seeds of the West’s own demise, accelerating Global entropy. Weakened finances, militaries and industrial capacity have left the West very vulnerable as great powers competition re-emerged.

🔹 Mercantilism (with Chinese characteristics)

China’s rise was driven less by “cheap labor” and free markets than by state-directed industrial policy and subsidies that allowed China to climb both the value-added and technology ladder with unprecedented speed, but at the cost of beggar-thy-neighbor strategies that undermined global welfare and destabilized open economy trade.

🔹 $Bloc / Chinese co-prosperity sphere

Following its WTO accession, China facilitated its rapid growth by creating and enabling pseudo currency union with resource producing emerging markets and the US. China positioned itself in the middle as the factory floor for conversion of emerging markets’ resources into US consumer products, all facilitated by its stabilization of exchange rates through mass intervention.